Posts Tagged ‘home values’

Great Expectations–2024 Crystal Ball Award-Winners

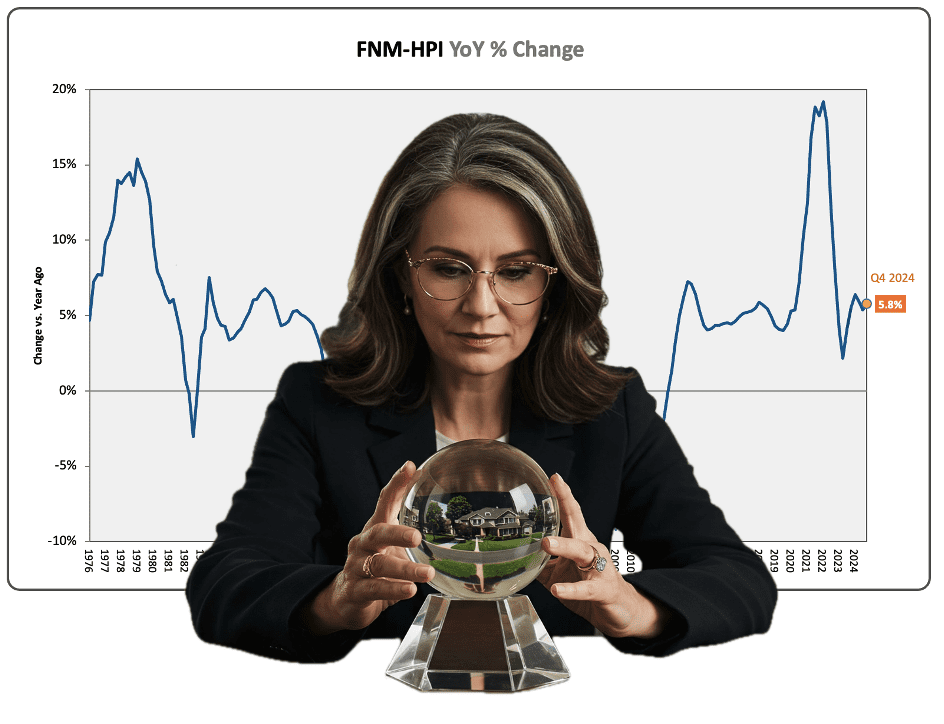

For fifteen years running, the Home Price Expectations Survey (HPES), produced by Pulsenomics in partnership with Fannie Mae, has served as a real estate market barometer and go-to resource for anyone trying to understand where U.S. home prices might be headed. Each quarter, over 100 expert panel members share their outlook and perspectives, forecasting the…

Read MoreGreat (Home Price) Expectations

Every quarter for more than 12 years, at least 100 members of an expert panel managed by Pulsenomics participate in the Zillow Home Price Expectations Survey to predict the 5-year future path of U.S. home prices and weigh-in on topical concerns pertinent to residential real estate and mortgage markets. In every year since the survey’s 2010…

Read MoreMillennials’ Homeownership Aspirations Still Strong

Since the historic U.S. housing bust, there has been much speculation that millennials would lead a permanent shift away from homeownership. The latest U.S. Housing Confidence Survey of 10,000 heads of household–3,095 of whom are of the millennial generation–confirm yet again that renter households headed by 18-34 year-olds continue to have a hearty appetite…

Read MoreMillennials, Californians High on Housing

The latest Zillow Housing Confidence Index (ZHCI) reveals that homeowner expectations are higher than they were two years ago in the majority of metro areas tracked, and nowhere are they higher now than in The Golden State. The ZHCI homeowner expectations sub-indexes for Los Angeles, San Francisco, and San Jose are now 77.5, 77.3,…

Read MoreLong-term outlook for U.S. home values dims

The long-term outlook for U.S. home values has diminished to a three-year low, and a clear-cut consensus among the experts remains elusive at the national level. This, according to The Q4 edition of the Zillow Home Price Expectations Survey published today. (Pulsenomics conducted the survey and collected 108 responses). Based on the projections of the most…

Read MoreThe Housing High (and Comedown?) in Denver

Data from the July edition of the U.S. Housing Confidence Survey of 10,000 households (HCS) and the Zillow Housing Confidence Index (ZHCI) highlighted the recent smoking-hot conditions in the Denver housing market. For example, at 77.9, the Housing Market Conditions Index (a ZHCI component) for Denver was at the highest level of all cities…

Read MoreHouseholds Ditch The Rear View Mirror

Real estate is a notoriously inefficient asset class. One symptom of market inefficiency is price inertia, a hallmark of housing markets. However, a comparison of actual U.S. home value changes in the recent past to expected changes for the near future (see below chart) suggests that as households ride the road to real estate…

Read MoreLower Expectations Dent Housing Confidence

According to the vast majority of 10,000 heads of household who participated in the latest U.S. Housing Confidence Survey conducted by Pulsenomics, prevailing real estate market conditions are healthy, and in most major metropolitan areas, have continued to improve. However, expectations concerning the housing market–while still positive–have reversed course since the start of the…

Read MoreGreat (and Quite Variable) Expectations

“I have been bent and broken, but – I hope – into a better shape.” – Charles Dickens, from Great Expectations The U.S. Housing Confidence Survey (HCS) includes several questions regarding expectations for future home values within the local market where each head of household respondent resides. We ask the questions and carefully monitor…

Read MoreRenter Aspirations Bottoming in Boston, Booming in L.A.

The level of housing confidence today can influence economic consumption, and supply & demand for residential real estate tomorrow. This is why it is essential to measure and monitor housing confidence. In any real estate market, aspirations for future homeownership among today’s renters are key indicators of housing confidence. The Homeownership Aspirations Index (HAI)–one…

Read More