Home Price Expectations Tick Up–But Consensus Is Elusive

The results of the latest (Q2) edition of Pulsenomics’ Home Price Expectations Survey have been released, and they reveal that most of our expert respondents have become less downbeat about the 2023 outlook for U.S. home values. The survey data were collected May 9th– May 23rd.

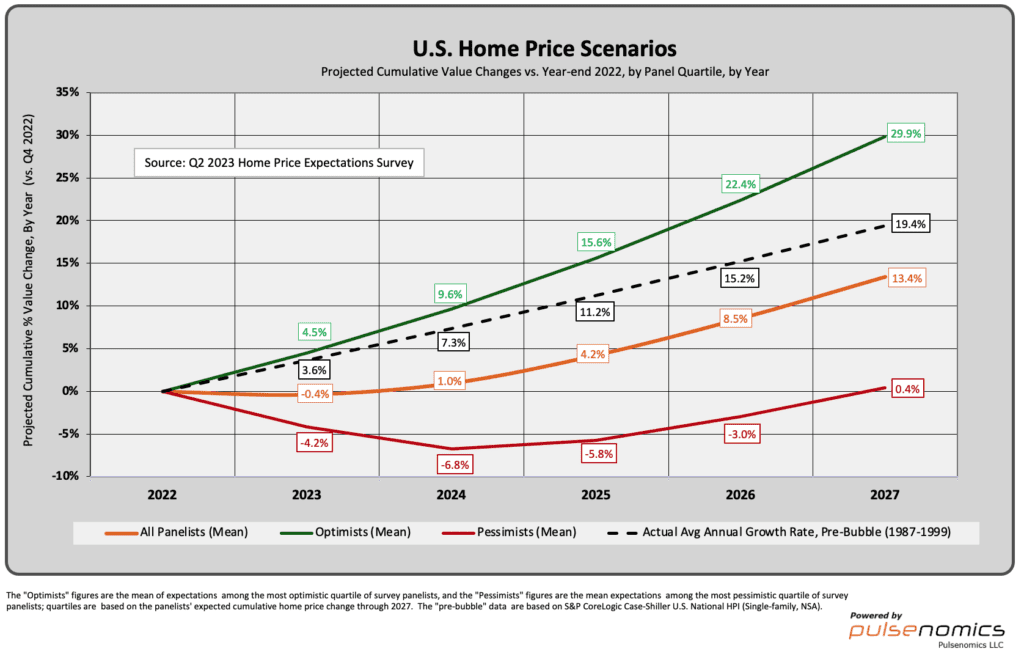

- The mean of all 109 responding panelists’ expectations indicates that nationwide home prices will fall 0.4% in 2023. Although this is a more optimistic view compared to our prior (Q1) survey–when the mean panel-wide projection was a 2.0% decline—it’s well below the panel-wide mean forecast of a 4.2% increase for 2023 recorded one year ago.

- Just under one-half of the Q2 respondents expect U.S. home prices to register a negative change this year; in our Q1 survey, two-thirds of respondents projected a nationwide price fall in 2023 (one year ago, only 10% of our expert panel was predicting that a nationwide price decline).

During the past few years, the number and nature of factors one could consider in formulating a home price forecast are unprecedented—e.g., profound changes in consumer preferences in the pandemic’s aftermath, a super spike in mortgage rates from a years-long floor, stubbornly low single family housing inventory levels, decades-high inflation, unprecedented government stimulus programs, increasing uncertainty regarding evolving work-from-home policies, a resilient yet recession-prone economy—and make consensus elusive. Although the dispersion of expectations among our survey panelists has diminished from an all-time high last year, it remains elevated.

The chart above is one depiction of the divergent views among the Pulsenomics expert panelists. The green line represents the mean cumulative home price expectations of the most optimistic quartile of respondents, and the red line represents those of the most pessimistic quartile. The 5-year forecasts of the optimists suggest that the nominal aggregate value of the U.S. housing stock will grow by more than $14 trillion by the end of 2027, while the 5-year projections of the most pessimistic group imply the value will grow by just $200 billion, or less than 2% as much.